Job Title: Chief Financial Officer

Congratulations! You just got a promotion, you are now CFO of Yourself Inc.

This post is not financial advice, as ever it is just my own point of view.

In Argentina, everyone has at least two jobs. The first is their day job(s), the second is their financial administration. Argentina has struggled with high inflation for many years, recently it climbed to over 100%. Their currency, the Peso, has also collapsed. In 2018, $1 would buy you around 20 pesos, by 2021 this was nudging 100 pesos. The official exchange rate at the time of writing is around 350 pesos for every $1. On the unregulated markets, this exchange rate is more like $1 to 720 pesos.

With high inflation and their currency in free-fall, life is a constant struggle for most people. It is almost impossible to plan for any expenses as prices change so rapidly. I highly recommend watching the documentary “Follow the Money” episode 4 “Argentina’s Inflation Crisis”. This is a brilliant series and I am looking forward to the next episode about Lebanon.

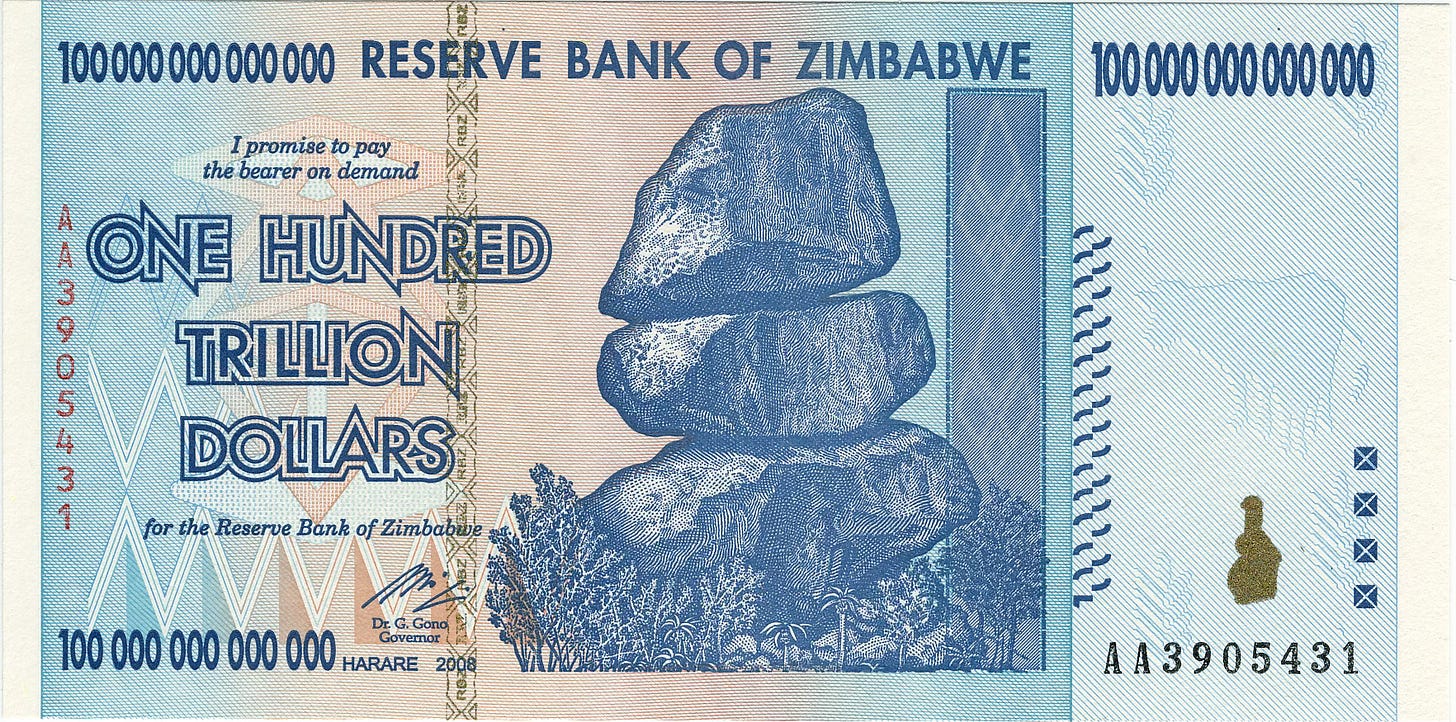

High inflation is not unique to Argentina. Remember the news stories of the 100 trillion Zimbabwean dollar bill? But it is not something which we in the west have had to deal with in recent memory. I have never really noticed inflation on a day-to-day basis until recently. Sure you can’t buy a can of Coke for 50p anymore like you could when I was a kid, but it’s not something I would think about regularly. The exception to this was when the global financial crisis was happening and governments started printing money like crazy. My high school economics told me this would have an inflationary effect but it never really materialised. Add COVID-19 stimulus to the mix with restricted supply and those chickens have well and truly come home to roost.

The thing which really hit home when watching the documentary on Argentina was how inflation disproportionately affects the poorest in society. Now you might think this is obvious, prices are going up so the people with less money are not able to afford as much. Those with more might have to give up the odd latte here and there, but it doesn’t really affect them. Yes, this is true, but the more insidious aspect is the richer in society can also protect themselves better from inflation. They have access to a whole load of tools and the financial resources to use them. They can purchase foreign currency, buy property or land, purchase assets, invest in the markets overseas, amongst other things.

Sure, the more affluent do this in western countries also, but until recently, even if you had no interest in finance as long as you spent less that you earned, you would generally be alright. You could put the leftover in a savings account and it would be there for a holiday or when the washing machine breaks down. Not anymore. Now that money sat in your saving account is melting away as its purchasing power is eroded by inflation. For the first time in a long time, people in western countries must think like those in Argentina, and if you aren’t, it is well and truly time to start. Being able to save by putting your money in a bank account is a luxury you probably didn’t appreciate but no longer have.

The irony in all this is it is governments thinking they are doing the right thing (sometimes) which has caused a lot of the problems. Governments have printed and borrowed enormous sums of money to bail out banks, pay for stimulus and welfare, etc. But this is good you say? This goes to the neediest in society. Sometimes maybe, and I am not arguing the state should not provide healthcare and welfare, but the amount of spending has blown out of control. UK government debt repayments are now more than what is spent on education. When governments face this sort of situation, what do they do? Increase the money supply, which nudges up inflation and their debt seems smaller. They inflate it away. The same happens when you buy a house. Initially, the mortgage payments might be a stretch but over time - all other things being equal - prices go up, you get pay rises but the amount you borrowed is locked in and starts to look smaller. The only difference is you are not engineering this. You don’t have a money printer in your bedroom, but the government does. If you did, and could use it to pay off your debts, would you? Would you use it even if you knew in the long run you are making life difficult for some of the poorer in society? If all you care about is the next election cycle, why not kick the can further down the road?

So what can you do to protect yourself? Well, buy a house of course and ride the wave. This has been the traditional major investment people make, at least in a lot of western countries. Nothing is as safe as houses, right? The problem is young (and not so young) people can’t afford to do this anymore. It has been inflated away from them.

There are alternatives. More than anything, you should educate yourself as much as you can. There are a number of things you could look into. Bitcoin for example, not cryptocurrency, Bitcoin. Read the Bitcoin White Paper. I am not saying go out and buy a load of Bitcoin and wait for the price to spike. Have an open mind and do some research into it. Set up a wallet and buy a small amount. Move it around and see how it works. Learn about self custody, hardware and software wallets. Read a little about Austrian Economics. I admit I first looked into Bitcoin as a speculative asset, but the more I learned, the more my eyes were opened to how broken the current financial systems are. Some good places to start are:

(L)earn Bitcoin by Anita Posch

Look into other assets; Gold, Silver and other commodities. Look into stocks; index funds are probably the best place to start. There is no right or wrong answer, but do copious amounts of research and don’t dive into anything all in.

As I mentioned earlier, some people are all over this already, but if you are not, take a moment to step back and do some research. In the west we have had the luxury of choosing to ignore the complexities of managing your wealth if you so choose. This is now over.

Circling back to Bitcoin, along with hedging against inflation, there are other reasons why it may pay to give it a look. I promise I’m not wearing a tinfoil hat here by the way. Central Bank Digital Currencies (CBDC) are one reason. Without going into details here (maybe I’ll save this for another post) a CBDC is a government issued digital currency, which crucially the government retains control of. These are on the horizon. Most countries are investigating them and a number have already implemented them. There are many advantages touted, such as increased security and efficiency. However, the government retains control of it and therefore it can easily be used for social manipulation. Do some research into these and China’s Social Credit System. When combined the result is terrifyingly Orwellian.

Back in Argentina, Javier Milei, a far right populist likened to Donald Trump, Jair Bolsonaro, and Wolverine has just been elected president. His nickname is El Loco - the Madman, and he certainly has some controversial views. He has though vowed to abolish the central bank and dollarise the economy in order to fight inflation. It will be interesting to see how this works out.

As for yourself, remember you are the CFO.

If you enjoy reading “From a Certain Point of View” please consider sharing this blog with anyone else you think would find it interesting. Thanks!